SOCAR Secures Wider Role in European Energy Market After Italian Refinery Deal

By Rauf Mammadov

Azerbaijan’s State-owned Oil Company, SOCAR, announced last week that it had signed a deal to acquire Italiana Petroli (IP), one of Italy’s top refining and distribution players. The deal signals SOCAR’s boldest push yet into Europe’s energy market. With regulatory approval pending, the acquisition would hand SOCAR control of more than 4,500 service stations, two refineries, aviation fuel businesses, and extensive logistics assets across Italy.

This development is not just another commercial transaction. It is a move that captures the intersection of economics, politics, and strategy. For Azerbaijan, the deal is about more than buying assets — it is about embedding itself directly inside Europe’s energy system at a time of shifting geopolitics.Three key reasons explain why this agreement is significant:

First, it marks SOCAR’s first major refinery investment inside the European Union (EU). Up until now, the company’s European acquisitions were largely focused on the retail end of the chain — fuel station networks in Switzerland, Romania, and Austria. Those moves gave SOCAR a visible brand presence but not necessarily deep industrial capacity.

Refining changes that equation. By acquiring Italiana Petroli’s assets, SOCAR is moving downstream in a way that allows it to capture margins at multiple energy points — from crude exports to refining to retail sales. This reflects a broader industry pattern as international oil majors like ExxonMobil and Shell divest from refining and petrochemical assets in the continent, national oil companies (NOCs) are stepping in to fill space. SOCAR’s acquisition demonstrates that Baku is no longer satisfied with simply being a crude oil exporter. It wants to maximize the value of every barrel by processing it closer to European end-consumers, turning oil into refined products that command higher returns.

Map Source: Economist Intelligence Unit, EIU Profile

SOCAR’s Italian Springboard to Europe

Italy is a logical place for this leap. It has long been one of the largest buyers of Azerbaijani crude, supplied through the Baku–Tbilisi–Ceyhan (BTC) pipeline and the Mediterranean. By securing refining capacity in Italy, SOCAR ensures a natural buyer for its crude while gaining a foothold inside the EU’s value chain.

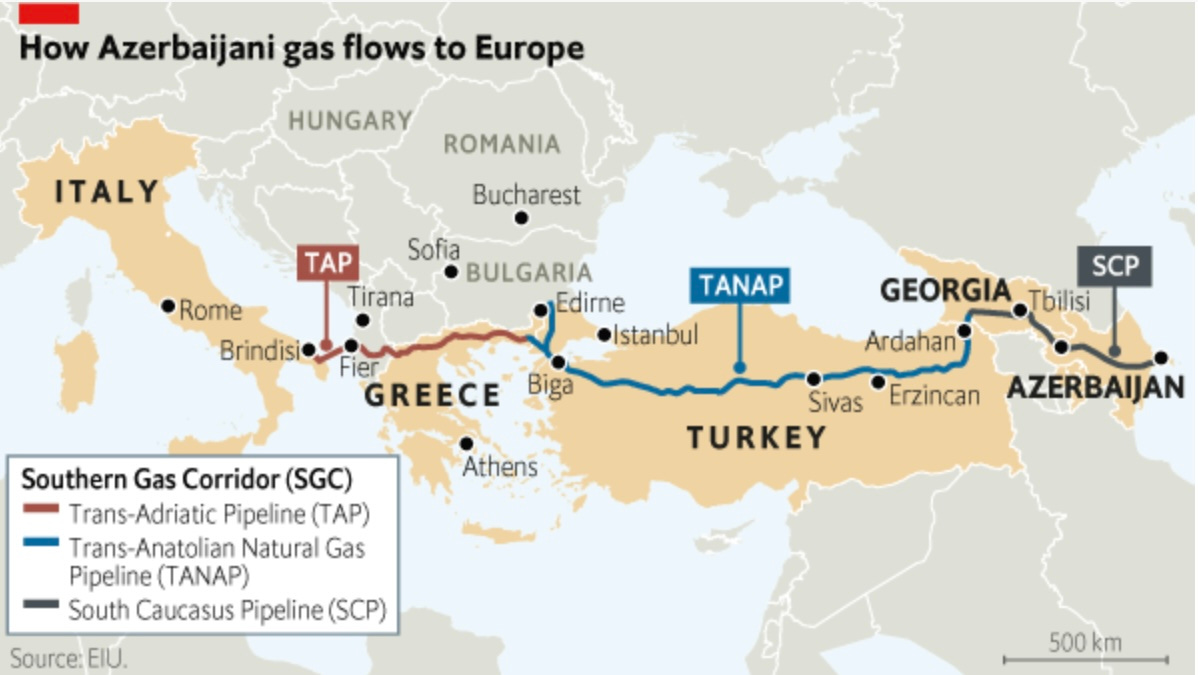

Second, the deal highlights the political undertones that often shape energy investments. Italy has consistently ranked as Azerbaijan’s top crude oil customer in the EU, and it is also the termination point of the Trans Adriatic Pipeline (TAP), which carries Azerbaijani natural gas into southern Europe. This commercial reliance has spilled over into diplomacy. During the Second Karabakh War in 2020, France openly backed Armenia, taking a vocal position in European forums. Italy, by contrast, adopted a more pragmatic and low-profile approach, quietly prioritizing its energy partnership with Baku. That pragmatism has now translated into deeper commercial integration. For Azerbaijan, acquiring Italiana Petroli does more than extend its downstream footprint — it solidifies a bond with a major EU state that has shown itself to be both commercially important and geopolitically pragmatic.

Third, the acquisition fits into SOCAR’s broader Mediterranean and Black Sea strategy. In Turkiye, SOCAR already operates the STAR refinery in Izmir and controls Petkim, the country’s largest petrochemical complex. In Central and Eastern Europe, SOCAR has built a smaller but significant footprint. It runs retail networks in Switzerland and Austria, and in Romania it operates fuel depots and filling stations. With Italy added to the mix, SOCAR is creating a triangle of influence stretching from the Caspian Basin through Turkey to the Mediterranean and deeper into Europe.

The timing here is especially important. Western sanctions have forced Russian energy companies to retreat from much of the European downstream market creating a prime opportunity for SOCAR’s strategic planners. That vacuum creates an opening for SOCAR to step in — not only to capture market share but also to brand itself as a politically reliable alternative. Reports also indicate SOCAR is interested in acquiring Lukoil’s Burgas refinery in Bulgaria, one of the largest refining assets in the Balkans. If that deal goes through, Azerbaijan’s presence in Europe’s downstream sector would expand even further, cementing its role not only as a supplier but also as a major regional operator.

Italy appears to be the centerpiece of SOCAR’s strategy, but it is not the energy company’s first foothold in Europe. Over the past decade, for example, the company has steadily built a retail presence in Switzerland, Austria, and Romania through the acquisition of fuel station networks and depots. Those earlier buys were about visibility and market access; the Italiana Petroli deal takes that strategy to an entirely new level. Together, these assets knit SOCAR into Europe’s downstream map from the Alps to the Balkans, turning what once looked like scattered assets into a coherent value chain.

This pattern mirrors a wider trend among the state owned energy operators. National oil companies from the Gulf — Saudi Aramco and Abu Dhabi National Oil Company (ADNOC), for example — have been steadily acquiring refining and petrochemical assets in Europe and Asia to secure markets for their crude. SOCAR is now pursuing a similar model, albeit on a smaller scale, positioning itself as both a commercial operator and a strategic partner.

Conclusion

The Italiana Petroli deal underscores this ambition. If approved, it would mark SOCAR’s leap from being a supplier knocking on Europe’s door to becoming an operator firmly inside the house. In today’s energy landscape, that shift could prove transformative — for Azerbaijan, for Italy, and for Europe’s broader energy balance.

In the past SOCAR’s role in Europe was mainly defined by its contribution to the European Union’s energy security as a reliable crude oil and natural gas supplier, while cautiously expanding into retail. Since then, however, its strategy has evolved. SOCAR is no longer content with being a dependable exporter — it is pursuing a proactive investment approach, embedding itself inside Europe’s downstream sector. Moreover, by building a chain of assets stretching from the Caspian Basin through Turkiye to Italy and the Eastern Mediterranean, SOCAR is positioning itself not just as an energy supplier, but as an integrated operator with a long-term stake in Europe’s energy future.

Author Bio:

👉Rauf Mammadov is a senior manager at Fuld & Company, specializing in energy issues. His research focuses on energy security, global energy industry trends, and energy relations between the Middle East, Central Asia, and the South Caucasus, with a particular emphasis on the post-Soviet countries of Eurasia.

Thank you for your support! Please remember that The Saratoga Foundation is a non profit 501(c)(3) organization. Your donations are fully tax-deductible. If you seek to support The Saratoga Foundation you can make a one-time donation by clicking on the PayPal link below! Alternatively, you can also choose to subscribe on our website to support our work.

https://www.paypal.com/donate/?hosted_button_id=XFCZDX6YVTVKA

Thanks for reading! This post is public so feel free to share it.